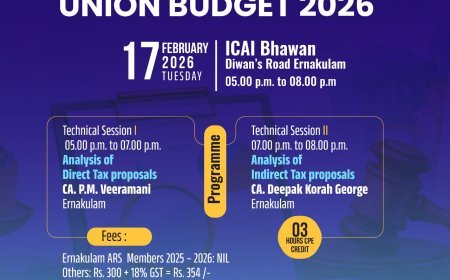

Budget 2024 Key Highlights LIVE Updates: No changes in direct, indirect tax rates; FY25 fiscal deficit target at 5.1%

Union Finance Minister Nirmala Sitharaman is set to present the Interim Budget for the financial year 2024-2025 in the Parliament today, February 1. The minister will begin her Budget speech at 10 am in the Lok Sabha today.

Union Finance Minister Nirmala Sitharaman presented her sixth Budget on February 1. This was an interim budget ahead of the general elections later this year. The Interim Budget 2024 was focused on youth and women empowerment, while maintaining fiscal consolidation and continuing capex. FM Sitharaman lowered down FY25 fiscal deficit target to 5.1% of the GDP. There were no changes made to the direct tax and indirect tax rates.

The Interim Budget 2024 can be accessed in a “paperless form" through the Union Budget Mobile App. The bilingual app, available in English and Hindi, can be downloaded from the Union Budget Web Portal - www.indiabudget.gov.in

Buy 2 or more full priced items get 10% off

Budget 2024 Key Highlights LIVE: Economy witnessed positive transformation in last 10 years: Sitharaman

Budget 2024 Key Highlights LIVE: The Indian economy witnessed positive transformation in the last 10 years. With Sabka Saath, Sabka Vikaas, the Narendra Modi-led government overcame per-2014 challenges.

Budget 2024 Key Highlights LIVE: Direct benefit transfer saved ₹2.7 lakh crore: FM Sitharaman

Budget 2024 Key Highlights LIVE: Direct benefit transfer of ₹34 lakh crore from the government using PM Jan Dhan Account led to savings of ₹2.7 lakh crore for the government. This saving has been realised through avoidance of leakages, said FM Sitharaman.

Buy 2 or more full priced items get 10% off

Garib kalyan is desh ka kalyan, says FM Sitharaman

Budget 2024 Key Highlights LIVE: Finance Minister Sitharman in her budget speech said Garib Kalyan is desh ka kalyan. We believe in empowering the poor. With the pursuit of Sab ka Saath, the government has helped alleviate 25 crore people from multidimensional poverty.

Budget 2024 Key Highlights : Garib, Mahilayen, Yuva and Annadata highest priorities of govt: FM

Budget 2024 Key Highlights LIVE: The needs and aspirations of Garib, Mahilayen, Yuva and Annadata are the government’s highest priorities, said Finance Minister Nirmala Sitharaman. Poor, women, youth and farmers are four castes for our government, she said.

Budget 2024 Key Highlights : PM Kisan Samman Yojana provided direct financial assistance to 11.8 crore farmers: FM

Budget 2024 Key Highlights LIVE: PM Vishwakarma Yojana provides end-to-end support to artisans and crafts people engaged in 18 trades. The schemes for empowerment of divyangs and transgender persons reflect the firm resolve of our government to leave no one behind. Every year, under PM Kisan Samman Yojana, direct financial assistance is provided to 11.8 crore farmers, including marginal and small farmers, says FM Sitharaman.

Buy 2 or more full priced items get 10% off

30 crore Mudra Yojana loans given to women entrepreneurs

The empowerment of women through entrepreneurship, ease of living and dignity has gained momentum in these 10 years. 30 crore Mudra Yojana loans have been given to women entrepreneurs, says FM Sitharaman.

To provide housing for middle class

Budget 2024 Key Highlights LIVE: The government will help housing for the middle class living in rented or slums or unauthorized colonies to build or buy their own houses, FM Sitharaman said

Ayushman Bharat to be extended to all Asha workers

Budget 2024 Key Highlights LIVE: Healthcare cover under Ayushman Bharat Scheme will be extended to all Asha workers, all Anganwadi workers and helpers, says FM Sitharaman.

Aim to double seafood exports to ₹1 lakh crore: FM

Budget 2024 Key Highlights LIVE: PM Matsaya Sampada Scheme will be stepped up for aqua culture productivity. The scheme will aim to double seafood exports to ₹1 lakh crore, says FM Sitharaman.

Aim to increase Lakhpati Didis to 3 crore: FM Sitharaman

Budget 2024 Key Highlights LIVE: The government now aims to increase Lakhpati Didis to 3 crore from 2 crore. Corpus of ₹1 lakh crore will be established with 50-year interest free loans for sunrise domains, saud FM Sitharaman.

FY25 capex target set at ₹11.1 lakh crore, up 11.1%

Budget 2024 Key Highlights LIVE: The capex target of FY25 has been set at ₹11.1 lakh crore, up by 11.1%, Sitharaman said.

40,000 rail bogies to be converted to Vande Bharat coaches

Government will expand key rail infrastructure projects including Metro Rail and Namo Bharat to more cities. Around 40,000 rail bogies will be converted to Vande Bharat coaches, Sitharaman said.

FY24 fiscal deficit revises down to 5.8% of GDP

Budget 2024 Key Highlights LIVE: Finance Minister Nirmala Sitharamam revises down FY24 fiscal deficit to 5.8% of GDP

FY25 fiscal deficit target pegged at 5.1% of GDP

Budget 2024 Key Highlights LIVE: FY25 fiscal deficit target has been pegged at 5.1% of GDP. .FY25 gross market borrowing pegged at ₹14.13 lakh crore, net borrowing at ₹11.75 lakh crore, FM Sitharaman said.

To provide ₹75,000 cr at 50-year interest free loan to states: FM

Budget 2024 Key Highlights LIVE: The union government will provide ₹75,000 crore at 50-year interest free loan to states. FDI inflows from 2014-2023 were at $596 billion, says FM Sitharaman.

FY25 tax receipts estimated at ₹26.02 lakh crore in FY25,

Budget 2024 Key Highlights LIVE: The tax receipts for FY 2024-25 are estimated at ₹26.02 lakh crore, said FM Sitharaman. She noted that the average processing time of tax returns has been reduced to 10 days this year.

No changes in direct, indirect tax rates

Budget 2024 Key Highlights LIVE: Finance Minister Nirmala Sitharaman announced no changes in direct and indirect tax rates. “...I do not propose any changes in tax rates in direct and indirect taxes including import duties," FM Sitharaman said in her Budget speech.

Revised Estimates for 2023-24

The Revised Estimate of the total receipts other than borrowings is ₹27.56 lakh crore, of which the tax receipts are ₹23.24 lakh crore. The Revised Estimate of the total expenditure is ₹44.90 lakh crore.

The revenue receipts at ₹30.03 lakh crore are expected to be higher than the Budget Estimate, reflecting strong growth momentum and formalization in the economy. The Revised Estimate of the fiscal deficit is 5.8% of GDP, improving on the Budget Estimate, notwithstanding moderation in the nominal growth estimates.

Budget Estimates for FY 2024-25

The total receipts other than borrowings and the total expenditure for FY25 are estimated at ₹30.80 and ₹47.66 lakh crore respectively. The tax receipts are estimated at ₹26.02 lakh crore.

The gross and net market borrowings through dated securities during 2024-25 are estimated at ₹14.13 and ₹11.75 lakh crore respectively. Both will be less than that in 2023-24. Now that the private investments are happening at scale, the lower borrowings by the Central Government will facilitate larger availability of credit for the private sector, FM Sitharaman said.

Buy 2 or more full priced items get 10% off

To withdraw outstanding direct tax demands up to ₹25,000 for up to FY10

FM Sitharaman proposes to withdraw outstanding direct tax demands up to ₹25,000 pertaining to the period up to financial year 2009-10 and up to ₹10,000 for financial years 2010-11 to 2014-15. This is expected to benefit about a crore tax-payers

Announcements for key sections of society

Budget 2024 Key Highlights LIVE: Finance Minister Nirmala Sitharman in her Interim Budget 2024 proposed a slew of measures to sustain growth, facilitate inclusive and sustainable development, improve productivity, create opportunities for all. Here are some of these announcements:

PM Awas Yojana (Grameen): 2 crore more houses will be taken up in the next five years to meet the requirement arising from increase in the number of families.

Rooftop solarization and muft bijli: Through rooftop solarization, one crore households will be enabled to obtain up to 300 units free electricity every month.

Housing for middle class: Government will launch a scheme to help deserving sections of the middle class “living in rented houses, or slums, or chawls and unauthorized colonies" to buy or build their own houses.

Medical Colleges: Government plans to set up more medical colleges by utilizing the existing hospital infrastructure under various departments. A committee for this purpose will be set-up to examine the issues and make relevant recommendations.

Cervical Cancer Vaccination: Government will encourage vaccination for girls in the age group of 9 to 14 years for prevention of cervical cancer.

Maternal and child health care: Upgradation of anganwadi centres under “Saksham Anganwadi and Poshan 2.0" will be expedited for 14 improved nutrition delivery, early childhood care and development

Ayushman Bharat: Healthcare cover under Ayushman Bharat scheme will be extended to all ASHA workers, Anganwadi Workers and Helpers.

Important announcements for Agriculture and food processing

Budget 2024 Key Highlights LIVE: The efforts for value addition in the agricultural sector and boosting farmers’ income will be stepped up, said FM Sitharaman. Here are the key proposals for the sector:

Buy 2 or more full priced items get 10% off

Pradhan Mantri Kisan Sampada Yojana has benefitted 38 lakh farmers and generated 10 lakh employment.

Pradhan Mantri Formalisation of Micro Food Processing Enterprises Yojana has assisted 2.4 lakh SHGs and sixty thousand individuals with credit linkages. Other schemes are complementing the efforts for reducing postharvest losses, and improving productivity and incomes.

For ensuring faster growth of the sector, Government will further promote private and public investment in post-harvest activities including aggregation, modern storage, efficient supply chains, primary and secondary processing and marketing and branding, said Sitharaman.

Focus on Infrastructure Development

Budget 2024 Key Highlights LIVE: Here are key announcements made in the Budget speech by FM Nirmala Sitharman on infrastructure development.

- Infrastructure outlay increased by 11.1% to ₹11.11 lakh crore

- 50-year interest-free loans to state governments extended for another year under Gati Shakti master plan

- Three major economic railway corridor programmes will be implemented. These are: (1) energy, mineral and cement corridors, (2) port connectivity corridors, and (3) high traffic density corridors.

- 40,000 normal rail bogies will be converted to the Vande Bharat standards to enhance safety, convenience and comfort of passengers.

- NAMO trains and metro rail services will be added in more cities

Subscribe and Save - 20% Off Your First Filter + Free Shipping and 20% Off All Refills

Meeting commitment for ‘net-zero’ by 2070

Budget 2024 Key Highlights LIVE: Towards meeting the commitment for ‘net-zero’ by 2070, the following measures will be taken:

- Viability gap funding will be provided for harnessing offshore wind energy potential for initial capacity of one giga-watt.

- Coal gasification and liquefaction capacity of 100 MT will be set up by 2030. This will also help in reducing imports of natural gas, methanol, and ammonia.

- Phased mandatory blending of compressed biogas (CBG) in compressed natural gas (CNG) for transport and piped natural gas (PNG) for domestic purposes will be mandated.

- Financial assistance will be provided for procurement of biomass aggregation machinery to support collection

Allocation for Specific Ministries

Budget 2024 Key Highlights LIVE: Here’s a list of money allocated to specific ministries:

- Ministry of Defence: ₹6.2 lakh crore

- Ministry of Road Transport and Highways: ₹2.78 lakh crore

- Ministry of Railways: ₹2.55 lakh crore

- Ministry of Consumer Affairs, Food & Public Distribution: ₹2.13 lakh crore

- Ministry of Home Affairs: ₹2.03 lakh crore

- Ministry of Rural Development: ₹1.77 lakh crore

- Ministry of Chemicals and Fertilizers: ₹1.68 lakh crore

- Ministry of Communications: ₹1.37 lakh crore

- Ministry of Agriculture and Farmer’s Welfare: ₹1.27 lakh crore

Macroeconomic takeaways from Interim Budget

- FY25 Fiscal Deficit target at 5.1% of GDP

- FY24 Fiscal Deficit seen at 5.8% of GDP

- Govt aims to reduce fiscal deficit to below 4.5% by FY26

- FY25 Capex outlay at 3.4% of GDP

- FY25 Net market borrowing seen at ₹11.75 lakh crore

- FY24 Gross Market Borrowing seen at ₹14.1 lakh crore

- FY24 Total Expenditure Revised Estimates at ₹44.90 lakh crore

- FY25 divestment target at ₹50,000 crore

- FY24 divestment target cut to ₹30,000 crore

Takeaways for the Banking and Insurance sectors

Here are key takeaways pertaining to the Banking and Insurance sectors in the Interim Budget 2024 announced by Finance Minister Nirmala Sitharaman

Corpus for long-term financing for sunrise sectors

A corpus of ₹1 lakh crore will be created to provide 50-year loans at low or nil interest rates to encourage the private sector to scale up research and innovate in sunrise sectors.

Subscribe and Save - 20% Off Your First Filter + Free Shipping and 20% Off All Refills

Housing for the middle class

The government will launch a scheme for deserving sections of the middle class living in rented houses or slums to build or buy their own houses.

This would have a second order impact in terms of aiding the housing finance businesses of banks. The potential key beneficiaries among banks would be the ones with a relatively higher share of home loans in their loan book viz. ICICI Bank and SBI, said Shivaji Thapliyal, Head of Research and Lead Analyst, Yes Securities.

Increased coverage for Ayushman Bharat

Healthcare cover under Ayushman Bharat will be extended to ASHA workers, Anganwadi workers and Helpers.

Certain benefits to start-ups & tax exemptions to be extended

Budget 2024 Key Highlights LIVE: Certain benefits to start-ups & tax exemptions to certain IFSC units expiring in March will be extended to March 2025.

Budget guarantee of strengthening foundation of developed India: PM Modi

Budget 2024 Key Highlights LIVE: Prime Minister Narendra Modi asserted that the Union Budget 2024 presented by Finance Minister Nirmala Sitharaman offers the “guarantee" of strengthening the foundation of a developed India. Here are key highlights from PM Modi’s statement:

- Budget will empower the four pillars of developed India, namely the young, poor, women and farmers.

- This is a budget of creating India’s future and is a reflection of the aspirations of a young India

- Budget empowers the poor and middle class and will create countless employment opportunities for youth

- The “historic" budget has also offered rebates for start-ups.

- It has provisions for a huge capital expenditure of ₹11.11 lakh crore while keeping the fiscal deficit under control

Highlights of Revenue Expenditures

Budget 2024 Key Highlights LIVE: In the Budget Estimates of FY 2024-25, expenditure on the revenue account has been estimated at about ₹36.55 lakh crore (11.2% of GDP) which is 3.2% over ₹35.40 lakh crore in RE 2023-24. Few significant items under the revenue expenditure head are below:

Interest Payments

In BE 2024-25, interest payment bill is estimated at ₹11.90 lakh crore, which at 3.6% of GDP is at par with RE 2023-24.

Major Subsidies

Major subsidies at ₹3.81 lakh crore form roughly 10.4% of Revenue Expenditure in BE 2024-25. The major subsidies as a percent of GDP are expected to decline from 1.4% in RE of 2023-24 to 1.2% in BE of 2024- 25. Further, upward revision of Food Subsidy in RE 2023-24 to ₹2.12 lakh crore as compared to ₹1.97 lakh crore in BE 2023-24 was mainly on account of the extension of the free food grain programme PMGKAY and payment of write-off accrued under the erstwhile ‘Food for Work programme’.

Finance Commission Grants

In BE 2024-25, the Finance Commission grants are estimated at ₹1.32 lakh crore.

Pensions

Central Government’s expenditure on pensions is expected to be at ₹2.40 lakh crore in BE 2024-25, representing 0.7% of the estimated GDP.

India has had three consecutive years of 7% GDP growth

India has had three consecutive years of 7% GDP growth and is the fastest growing economy in G20, says Finance Minister Nirmala Sitharaman in her post-Budget press conference.

GDP is Government, Development and Performance. We have delivered on Development and have better managed the economy. We are bringing down the fiscal deficit despite very challenging times

No fixed target for disinvestments, says DIPAM secretary

Budget 2024 Key Highlights LIVE: We do not have a fixed target for disinvestment in FY25. That’s why we have kept ‘other receipts’ head. If we get an opportunity, we can even exceed that, said DIPAM Secretary Tuhin Kanta Pandey.

Capex from government will continue, it is important to continue it, said Finance Minister Nirmala Sitharaman noting that the government gave a good number on capex in this Budget as well, she added.

10 key takeaways from FM Sitharaman’s post-budget presser

Budget 2024 Key Highlights LIVE: From fiscal deficit target and government capex to her message to rating agencies, here are 10 key takeways from Finance Minister Nirmala Sitharaman’s post-budget press conference.

Shop Our Washers And Dryers To Help You Tackle Laundry Day!

1] Finance Minister Nirmala Sitharaman stressed on 5 ‘Disha Nirdashak’ baatein: Social justice as an effective governance model; Focus on the poor, youth, women, and the Annadata (farmers); Focus on infrastructure; Use of technology to improve productivity and High power committee for challenges arising from demographic challenges.

2] India has had three consecutive years of 7% GDP growth and is the fastest growing economy in G20.

3] GDP is Government, Development and Performance. We have delivered on Development and have better managed the economy. We are bringing down the fiscal deficit despite very challenging times.

4] Capex from the government will continue, it is important to continue it, FM said.

5] India, Middle East, European Corridor (IMEC) project to be taken forward despite disturbances in Red Sea.

6] The withdrawal of 1.1 crore outstanding small direct tax demands for certain years will cost less than ₹3,500 crore to the exchequer, said Revenue Secretary Sanjay Malhotra.

Shop Our Washers And Dryers To Help You Tackle Laundry Day!

7] No extension of lower tax rate to new manufacturing units coming into place after March 2024, FM clarified.

8] Do not have a fixed target for disinvestment in FY25, said DIPAM Secretary Tuhin Kanta Pandey.

9] We are not only aligning with the fiscal consolidation path given earlier, but we are also bettering it, Finance Minister Nirmala Sitharaman said in her message to credit rating agencies

Subscribe and Save - 20% Off Your First Filter + Free Shipping and 20% Off All Refills

10] The relevance of the target to reduce the Centre’s debt-to-GDP ratio to 40% was set before COVID-19 period and now has to be examined, Finance Secretary TV Somanathan said.

What's Your Reaction?