An Assessee’s encounter with New Tax Regime : A Battle Against Belated Filing of Form 10IE u/s 115BAC

a. Basic Facts:

Mohanlal (imaginary name), an individual assessee with business income, opted for the new tax regime under Section 115BAC of the Income Tax Act for the Assessment Year (AY) 2021-22. The original due date for filing the Income Tax Return (ITR) for AY 2021-22 was September 30, 2021, but it was extended to March 15, 2022, due to the COVID-19 pandemic. Mohanlal, however, could file his ITR only on March 25, 2022, along with Form 10IE, which is a mandatory declaration for opting into the new tax regime for assessees with business income. Belated filing of the forms was, in fact, triggered by the havocs caused by the Pandemic.

The Centralized Processing Centre (CPC) processed Mohanlal’s return under Section 143(1) of the Act on June 30, 2022. During processing, the CPC denied Mohanlal the benefit of the new tax regime, citing the belated filing of Form 10IE (filed after March 15, 2022). This resulted in a higher tax liability for Mohanlal, as he was assessed under the old tax regime.

b. Many Remedies Unsuccessfully Tried:

Aggrieved by the CPC’s decision, Mohanlal unsuccessfully explored various avenues for redressal:

Approached PCIT (CPC Bengaluru): Mohanlal first approached the Principal Commissioner of Income Tax (PCIT) at CPC Bengaluru, seeking intervention u/s 119 of the Act. However, the PCIT declined to interfere, stating a lack of power to condone the delay in filing Form 10IE.

Approached Jurisdictional PCIT: Subsequently, Mohanlal also approached his Jurisdictional PCIT under Section 119 of the Income Tax Act, which grants the Board (CBDT) and other income-tax authorities’ power to issue instructions to subordinate authorities and condone delays in certain circumstances. Similar to the PCIT at CPC, the Jurisdictional PCIT also refused to interfere, reiterating their inability to condone the delay in this specific scenario.

Application to CBDT: As a final administrative recourse, Mohanlal filed an application directly with the Central Board of Direct Taxes (CBDT). This application sought their intervention and condonation of the delay in filing Form 10IE, given the extraordinary circumstances and the fact that the form was indeed filed before the return was processed. As of the current date, the application remains unacted upon by the CBDT, leaving Mohanlal in a state of limbo.

c. Appeal Before CIT (Appeals):

Having exhausted administrative remedies, Mohanlal now intends to file an appeal before the Commissioner of Income Tax (Appeals) [CIT(A)].

c.i. Prayer for Condonation – Probable Reasons:

Mohanlal’s primary prayer before the CIT(A) will be for the condonation of the delay in filing the appeal itself, as he has already exhausted significant time pursuing other remedies. The probable reasons he would cite for the delay in filing the appeal include:

Lack of Clarity on Forum: Mohanlal was initially uncertain about the appropriate forum to raise his grievance regarding the belated filing of Form 10IE and the CPC’s denial of the new tax regime. This led him to first approach various PCITs and then the CBDT, believing these administrative channels might offer a resolution.

Reliance on Administrative Remedies: He diligently pursued the available administrative remedies, hoping for a favourable outcome from the PCITs and the CBDT. The time spent on these unsuccessful attempts contributed to the delay in filing the appeal before the CIT(A).

Discovery of Relevant Precedent: Crucially, Mohanlal recently came across the significant decision of the Income Tax Appellate Tribunal (ITAT), Cochin Bench, in the case of Annie Joseph vs. Income Tax Officer, Ward 1, Kottayam (ITA No. 237/Coch/2025, dated April 30, 2025). This decision provided clarity on the legal position regarding the due date for Form 10IE and affirmed that an appeal is indeed the appropriate remedy for such grievances. This realization, albeit delayed, solidified his decision to file the appeal before the CIT(A).

Based on these reasons, Mohanlal can argue that the delay in filing the appeal was not intentional but arose from a genuine confusion regarding the proper forum and a diligent pursuit of perceived remedies, further compounded by the late discovery of a direct judicial precedent. He will emphasize that the appeal is now being filed promptly after understanding the correct legal position.

c.ii. Analysis of the Tribunal’s order and its relation to Mohanlal’s Facts:

The ITAT Cochin Bench decision in Annie Joseph vs. Income Tax Officer, Ward 1, Kottayam (ITA No. 237/Coch/2025, dated April 30, 2025) is a pivotal case for Mohanlal. Let’s delve into the facts and findings of this tribunal case:

Facts of Annie Joseph: The assessee, Annie Joseph, an individual, filed her return of income for AY 202122 on February 16, 2022 claiming the benefit of the new taxation regime under Section 115BAC. She filed Form 10IE on February 16, 2022. The CPC processed her return under Section 143(1) on March 22, 2022, accepting the returned income but denied the benefit of the new tax regime on the ground of belated filing of Form 10IE. The CIT(A) upheld the CPC’s action.

Relation to Mohanlal’s Facts:

Identical Assessment Year and Issue: Both cases pertain to AY 2021-22 and the central issue is the denial of Section 115BAC benefits due to the belated filing of Form 10IE.

CPC’s Rigid Interpretation: In both scenarios, the CPC adopted a strict and mandatory interpretation of the due date for Form 10IE, leading to the denial of benefits.

c.iii. Tribunal Held the Due Date for Filing Form 10IE is only Directory in Nature and not Mandatory:

The ITAT Cochin Bench, in the case of Annie Joseph, held that:

The requirement of filing Form 10IE is directory in nature and not mandatory.

The crucial point is that Form 10IE was “very much available with the CPC and the CPC ought to have considered the same allowing the benefit of New Tax Regime”.

The Tribunal directed the AO to amend the intimation by taking into consideration Form 10IE, as it was available with the CPC at the time of processing the return of income.

This decision is a powerful precedent for Mohanlal. It clearly states that even if Form 10IE is filed beyond the statutory due date for the ITR, if it is available with the CPC at the time of processing the return, the benefit of Section 115BAC should not be denied. The tribunal reasoned that the mere delay in filing a procedural form, when the substantive option is clearly exercised and the form is on record before the assessment, should not lead to the forfeiture of a beneficial provision. The intent of the law is to provide an option, and denying it solely on a technicality without any prejudice to the revenue is not justified.

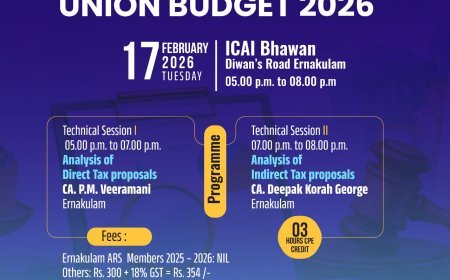

An article by CA. Prasanth Srinivas, Kottayam. Aricle published in Kottayam ICAI Monthly Newsletter

What's Your Reaction?