National GST Conference 2025: A Must-Attend Event for Taxation Professionals

National GST Conference 2025: Unlocking New Opportunities and Overcoming Challenges

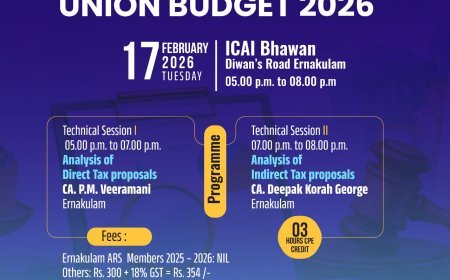

The Institute of Chartered Accountants of India (ICAI) is set to host the highly anticipated Two-Day National GST Conference on June 26–27, 2025, at The Renai Cochin, Palarivattom, Ernakulam. This event promises to be a landmark gathering, bringing together the brightest minds in GST to address challenges, explore opportunities, and share the latest developments in India’s taxation framework.

The conference will commence at 9:30 AM on June 26, with Shri S. K. Rahman IRS, Chief Commissioner of Central Goods and Services Tax (Thiruvananthapuram Zone), as the Chief Guest.

The program is packed with insightful sessions covering critical GST topics. Whether you’re a seasoned tax professional or a business owner navigating GST, this conference has something for everyone.

Registration Details

-

ARS Members: ₹3,068

-

Non-ARS Members: ₹3,540

Register now at www.kochiicai.org.

Venue

The Renai Cochin, Palarivattom, Ernakulam, 682025

The highlights of the National GST Conference 2025 include a series of expert-led sessions addressing key topics in GST. Shri S. K. Rahman IRS will open the discussions with a session on resolving GST disputes, focusing on effective mechanisms to reduce tax-related conflicts. CA. Rajendra Kumar P will delve into unlocking GST growth and practice opportunities, offering insights to leverage GST for business and professional development. CA. Shankara Narayanan V will present updates from the Finance Act 2025 and the latest GST Council recommendations, with a special focus on Input Service Distributors (ISD).

The conference will also feature CA. N. L. Soman, who will demystify the Reverse Charge Mechanism (RCM) by exploring its legal framework, exemptions, and practical nuances. Tackling reconciliation challenges between GSTR-2B and GSTR-3B, CA. Avinash Poddar will guide participants on mastering Input Tax Credit (ITC). Sr. Adv. G. Shivadass will address cross-border GST challenges, emphasizing place of supply rules, audits, and significant court decisions. Finally, Adv. K. Vaitheeswaran will provide a comprehensive understanding of GST on real estate and construction services, including valuation complexities and JDR provisions.

This conference underscores ICAI's commitment to equipping professionals with the knowledge and tools to navigate India’s dynamic GST landscape. With expert-led sessions and networking opportunities, it is the perfect platform to enhance your GST expertise and redefine your strategies. Don’t miss out on this unparalleled event!

What's Your Reaction?