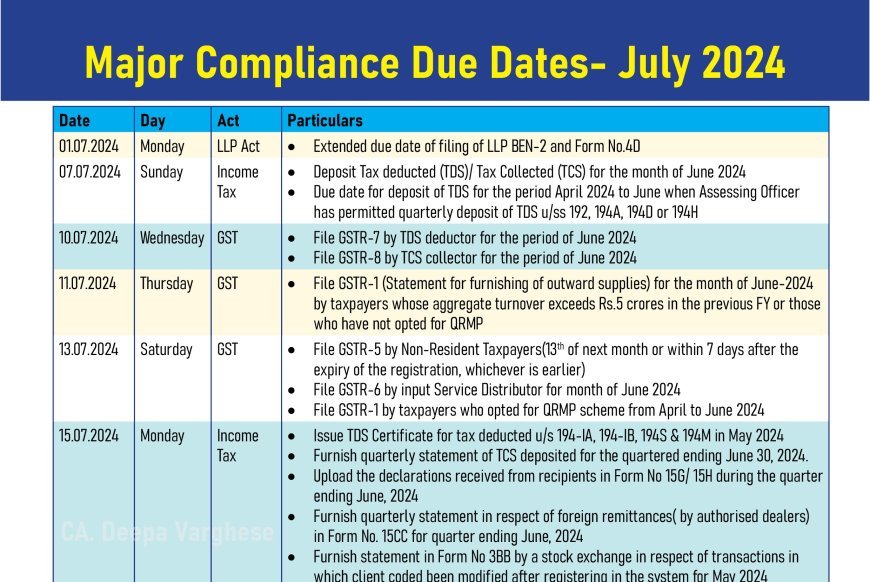

Major Compliance Due Dates- July 2024

| Date | Day | Act | Particulars |

| 01.07.204 | Monday | LLP Act | Extended due date of filing of LLP BEN-2 and Form No.4D |

| 07.07.2024 | Sunday | Income Tax | • Deposit Tax deducted (TDS)/ Tax Collected (TCS) for the month of June 2024 • Due date for deposit of TDS for the period April 2024 to June when Assessing Officer has permitted quarterly deposit of TDS u/ss 192, 194A, 194D or 194H |

| 07.07.2024 | Sunday | FEMA | • Report actual ECB transaction through Form ECB-2 return. |

| 10.07.2024 | Wednesday | GST | • File GSTR-7 by TDS deductor for the period of June 2024 • File GSTR-8 by TCS collector for the period of June 2024 |

| 11.07.2024 | Thursday | GST | • File GSTR-1 (Statement for furnishing of outward supplies) for the month of June-2024 by taxpayers whose aggregate turnover exceeds Rs.5 crores in the previous FY or those who have not opted for QRMP |

| 13.07.2024 | Saturday | GST | • File GSTR-5 by Non-Resident Taxpayers(13th of next month or within 7 days after the expiry of the registration, whichever is earlier) • File GSTR-6 by input Service Distributor for month of June 2024 • File GSTR-1 by taxpayers who opted for QRMP scheme from April to June 2024 |

| 15.07.2024 | Monday | Income Tax | • Issue TDS Certificate for tax deducted u/s 194-IA, 194-IB, 194S & 194M in May 2024 • Furnish quarterly statement of TCS deposited for the quartered ending June 30, 2024. • Upload the declarations received from recipients in Form No 15G/ 15H during the quarter ending June, 2024 • Furnish quarterly statement in respect of foreign remittances( by authorised dealers) in Form No. 15CC for quarter ending June, 2024 • Furnish statement in Form No 3BB by a stock exchange in respect of transactions in which client coded been modified after registering in the system for May 2024 |

| 15.07.2024 | Monday | P.F/ESI | • Deposit of ESI & PF collected during the month of June 2024 |

| 15.07.2024 | Monday | FEMA | • FLA Returns to be filed by the companies, LLPs, etc. which have received FDI and /or made overseas investment who holds foreign assets/ liability for FY 2023-2024. |

| 18.07.2024 | Thursday | GST | • File CMP-08 for the period of April to June 2024. |

| 20.07.2024 | Saturday | GST | • File GSTR-3B for the month of June 2024 by taxpayers whose aggregate turnover exceeding Rs. 5 Crore in the previous FY or those who have not opted for QRMP. • Fiel GSTR-5A by OIDAR services provided for the month of June 2024 |

| 22.07.2024 | Monday | GST | • File GSTR-3B for taxpayers who has opted for Quarterly filing as per QRMP Scheme for the period April 2024- June 2024 for specific states*. |

| 24.07.2024 | Wednesday | GST | • File GSTR-3B for taxpayers who has opted for Quarterly filing as per QRMP Scheme for the period April 2024- June 2024 for specific states**. |

| 25.07.2024 | Thursday | P.F | • Filing of Provident Fund Return for the month of June 2024. |

| 30.07.2024 | Tuesday | Income Tax | • Quarterly TCS certificate in respect of tax collected by any person for the quarter ending June 30, 2024 • Furnish Challan cum statement for TDS u/ss 194-IA, 194-IB, 194-S, 194-M in the month of June 2024 |

| 31.07.2024 | Wednesday | Income Tax | • Return of Income for the Assessment Year 2024-2025 for all assessee other than: • Companies or o Non-company assessee (whose books of accounts are required to be audited) or o Partner of a firm/ LLP whose accounts are required to be audited or the spouse of such partner if the provisions of Section 5A applied or o Assessee who is required to furnish a report u/s 92E. • Quarterly statement of TDS deposited for the quarter ending June 30, 2024 • Furnish quarterly return of non-deduction of tax at source by a banking company from interest on time deposit n respect of the quarter ending June 30, 2024 • Statement by scientific research association, university, college or other association or Indian scientific research company as required by rules 5D, 5E and 5F (if due date of submission of return of Income is July31, 2024) • Intimation in Form 10BBB by a pension fund in respect of each investment made in India for quarter ending June, 2024 • Intimation in Form II by Sovereign Wealth Fund in respect of Investment made in India for a quarter ending June, 2024 |

* Specified States: - Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, UTs of Daman , Diu and Dadra & Nagar Haveli, Puducherry, Andaman & Nicobar Islands & Lakshadweep.

**Specified States:- Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, J & , Delhi, UTs of Ladakh and Chandigarh

What's Your Reaction?