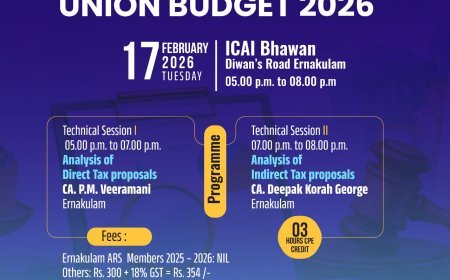

GST Council approved sweeping changes in indirect taxes at its 56th meeting

The GST Council meeting approved the crucial central recommendation to reduce the four GST tax slabs to two, 5% and 18%. Tax on many products and services, which were currently charged at 12% and 28%, has been reduced to 5% and 18% slabs respectively or completely eliminated. This will reduce the price of 175 products.

The meeting also accepted the long-standing demand to eliminate the 18% tax applicable to individual health and life insurance premiums. The changes will come into effect on September 22.

The crucial step comes amid assessments that the US's 50% substitution duty, including the one imposed by the US, will have a negative impact on Indian economic growth. All states, including Kerala, have supported the rate reduction. However, 8 non-BJP states, including Kerala, have protested against the lack of a compensation mechanism to compensate for the loss of revenue during the implementation of the reform.

99% of the items currently subject to 12% tax will be taxed at a reduced rate of 5%.

- With this, the tax on daily necessities, food items, medicines and educational expenses will be reduced to 5% or no tax at all.

- 90% of the items subject to 28% tax will be reduced to 18% tax.

- Seven items including tobacco, cigarettes, aerated drinks (e.g. cola) and pan masala will be taxed at 40%.

- 33 life-saving medicines will be completely exempted from 12% tax

- 3 life-saving medicines and medicines for cancer and rare diseases will be exempted from 5% tax.

- Tax on all other medicines will be reduced from 12% to 5%.

- Prices of small cars and two-wheelers up to 350 cc will be reduced. Tax will be reduced from 28% to 18%.

- Prices of ACs and televisions (above 32 inches) will be reduced.

- Lottery tax increased from 28% to 40%. This decision will be a setback for Kerala.

- The reduction in GST on cement from 28% to 18% will benefit the construction sector.

- The price of marble and granite will also come down

- Indian bread products like chapati and parota have been exempted from tax.

- Eight sectors such as agriculture, health, textiles, fertilizers, automotive and insurance will benefit.

What's Your Reaction?